After being pushed out of his first startup, René Lacerte spent 13 years building his bill-paying company into a unicorn. Now, 20 months later, it’s worth $10 billion.

On a gray and damp November day in 2004, René Lacerte nervously steered his silver Toyota Camry up Sand Hill Road to Silicon Valley venture firm August Capital for a board meeting. As cofounder and CEO of online payroll software startup PayCycle, Lacerte knew his job was on the line. The company had tens of thousands of users and $13 million in annualized revenue, but growth had stalled.

“I went into that meeting saying, ‘Give me one more chance,’” recalls Lacerte. Instead, the board asked him to step down. Five years later, PayCycle was sold to Intuit for $170 million.

In the meantime, Lacerte, now 53, started building his next company, Bill.com, which enables small businesses to pay their bills and keep their books in the cloud. While its name and function may be mundane, Bill.com Holdings, Inc. has performed in spectacular fashion since going public last December at $22 a share. Shares have increased more than five-fold to $126. That’s one of the best IPOs in fintech since the industry was born in 2005. Lacerte’s stock holdings are now worth $350 million, and yes, this time he’s still the CEO.

Covid-19 has been a boon for many fintechs as people stuck at home move more transactions online. Buy-now, pay-later app Afterpay has seen its stock rise tenfold and its market value hit $20 billion, while competitor Affirm’s imminent IPO could value it as high as $10 billion. Digital bank Chime has ballooned to a $14.5 billion valuation. Debit card transaction processor Marqeta is planning an IPO that’s rumored to value the company at up to $10 billion.

For Bill.com, the pandemic has been more of a mixed bag. Companies have continued to sign up for the service, but growth of both customers and transactions has slowed as many small firms have been hit hard. Still, the business Lacerte has so doggedly built now enjoys what Warren Buffett would call a moat—meaning it’s hard for other startups to enter its niche. Getting overwhelmed small business owners to do anything new is tough, and Bill.com has a critical mass and a long list of partners (from accountants to banks and Intuit itself) promoting its service.

As of September 30th, 103,600 businesses were making their payments through Bill.com, while more than 2.5 million suppliers had signed up to receive funds electronically through the service. Between software subscription and transaction fees, Bill.com books an average of about $1,500 in revenue a year for each of those 100,000-plus bill-paying clients.

Rene Lacerte grew up in Winter Haven, Florida, part of an extended family of entrepreneurs, bookkeepers and accountants stretching back to his great-grandparents. His own parents developed five businesses between them, including a temp agency and a payroll company for mom-and-pop shops. If the Lacerte name sounds familiar, that’s because two second-cousins built Dallas-based Lacerte Software Corp. into a leading tax-prep product for pros before selling their private company to Intuit (the owner of TurboTax) for $400 million in 1998.

After earning a B.A. in economics and an M.S. in industrial engineering at Stanford, Lacerte spent three years as a PwC auditor and a year at his parents’ payroll company before joining Intuit in 1994. There, in the late 1990s, he pitched the idea of putting Intuit’s QuickBooks accounting software on the Internet instead of requiring people to install it from a CD-ROM. It was a cloud-based business idea before the term cloud was coined, let alone cool. Intuit wasn’t interested, so in 1999—the same year Marc Benioff started Salesforce.com—Lacerte founded PayCycle. He was just 32.

The timing was less than ideal, given that he was trying to raise capital in the fall of 2000, just after the dotcom bubble burst. After 79 venture capitalists shooed him away, August Capital’s David Hornik invested almost $8 million. Hornik later led the move to replace Lacerte as PayCycle’s CEO, he says, because nice-guy Lacerte had ceded too much authority to a cofounder and his COO. “It’s hard to be agile when you are trying to accommodate so many opinions,’’ says Hornik, who was also an early investor in Bill.com.

Gradually, Then Suddenly

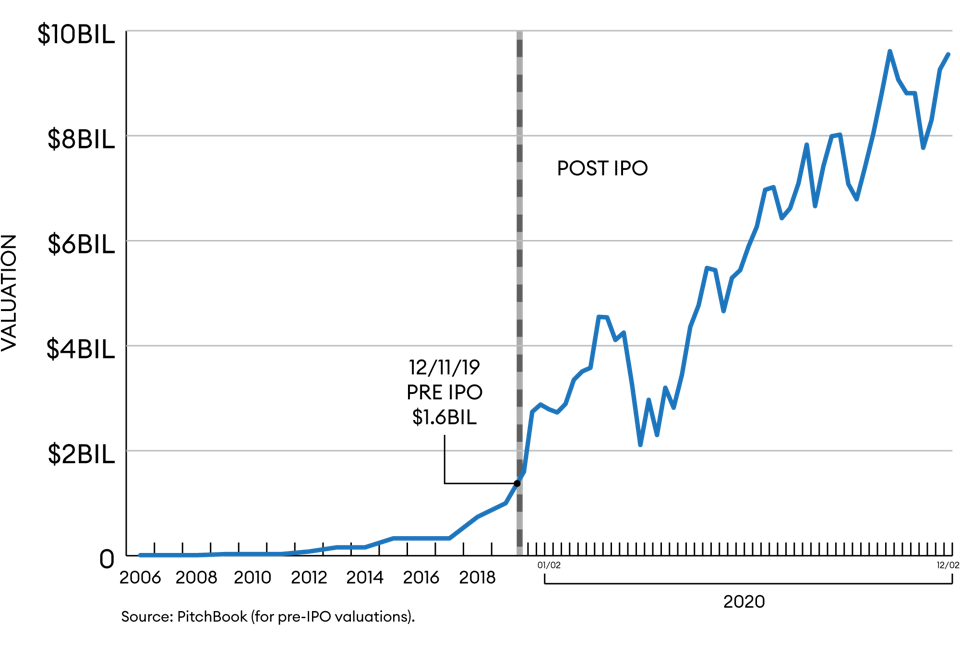

A steady strategy of building partnerships, followed by an IPO and Covid turbo boost, have sent Bill.com’s value into the stratosphere.

Fortunately, when he was sidelined at PayCycle, Lacerte was already hatching the idea for his next cloud business. He saw it as a massive timesaver for overworked small business owners—no more opening the mail, checking invoices, juggling when to pay which bill and then writing out, recording and reconciling checks by hand. In 2007, he paid $200,000 for the domain name Bill.com. He released his first product in 2008, targeting companies with $5 million to $100 million in revenue. The business model was to charge a monthly subscription and transaction fees to businesses to pay their bills online, plus a small fee to nonsubscribers for the payments they received.

There are 30 million small businesses in the U.S., but getting even a tiny fraction of them to adopt something new isn’t easy. Lacerte saw partnerships as the way and started out pitching Bill.com to accountants who each had dozens or hundreds of small business clients. After five years, he had sold it to 1,500 accountants—hardly the sort of fast adoption venture capitalists crave. “Many of René’s early investors were sometimes frustrated by the ‘slow’ progress in the early years,” says Tom Blaisdell, a former partner at venture firm DCM who led its 2006 investment in Bill.com.

After accountants, Lacerte targeted banks. “He’d look at JPMorgan and say, ‘We’re going to have this first meeting, and we’re probably about three to five years away from this having a big impact on our business,’’ recalls Blaisdell. “What entrepreneur has that kind of patience?” In 2016, he struck a partnership with his old employer Intuit to integrate Bill.com into its QuickBooks software. The next year, he finally landed a deal with JPMorgan to have their bankers begin recommending Bill.com to their business customers and has since inked deals with PNC, Bank of America and Wells Fargo.

Slowly but surely, the partnerships have started paying off. In 2018, revenue hit $65 million. An April 2019 fundraising round finally valued Bill.com at more than $1 billion. Last December, Bill.com went public with a $1.6 billion valuation. On the first day of trading, shares jumped 60%.

“His company meetings are very different from some of the young-buck startups that hang out on Fridays with a beer in their hand just to look cool.”

When Lacerte ran his first quarterly earnings call in February 2020, the numbers were good, with revenue growing 60% compared with a year earlier. But a bigger narrative was driving the stock’s gains. Wall Street found Lacerte refreshing, says David Chao, the founder of VC firm DCM. Chao calls René a “Steady Eddie … He is not a flamboyant person. He is a very thorough thinker. He does not exaggerate. He hits his numbers … his company meetings are very different from some of the young-buck startups that hang out on Fridays with a beer in their hand just to look cool.”

Still, despite his middle-aged, mild-numbers-guy demeanor, Lacerte had learned a lesson from his PayCycle ouster: to take firm control. “I realized that if I wasn’t going to make a big decision, no one will, so I need to make it.”

When the Covid stay-at-home era began, the need for an online bill payment service became even clearer. Josh Levine, who runs a small business outside Philadelphia that helps wealthy families manage their everyday expenses and assets, used to have his employees and couriers visiting clients’ homes multiple days a week to manage their bills. In mid-March, he switched to Bill.com, saving his six-employee team up to 15 hours a week and dozens of potentially disease-spreading exposures.

The potential is enormous. “Eighty to 90% of businesses still rely on paper checks as a primary form of payment,” says Noran Eid, an analyst at Kayne Anderson Rudnick, an asset management firm holding a $700 million stake in Bill.com. For those who want to invest in the switch to online payment, Lacerte’s company is the only “pure play,” she adds.

Bill.com also sits in a category that investors love: digital payments. Square, Bill.com and PayPal have been among the best-performing stocks since the pandemic started, with their stocks up 150%, 110% and 80%, respectively, compared with a 10% rise for the S&P 500.

Bill.com’s early investors August Capital and DCM have each turned $25 million into $700 and $900 million, respectively.

And then there’s that trusty old moat. A bill-paying service works best when both parties in each transaction—say, the restaurant buying vegetables and the food distributor providing them—are registered Bill.com users. So, like PayPal and other companies that have built two-sided marketplaces, the service gets more valuable as more companies join its network. “Scale feeds on itself,” Lacerte says.

The fast growth—and the market’s anticipation of more—has produced stunning returns for some of Bill.com’s early investors. DCM has already pocketed $680 million and still holds $240 million in stocks—all from a $25 million investment. August Capital’s $25 million bet turned into nearly a $700 million return. “It’s the best investment I ever made,” David Hornik says.

The challenge now is for Bill.com to live up to its lofty valuation. At $10 billion, or $126 per share, the stock is trading at 50 times next year’s expected revenue of $193 million, according to FactSet. (The price to earnings? That you can’t calculate since it lost $31 million over the last year, or $0.70 per share.) Only the best-performing pandemic stocks like Zoom trade at higher multiples. Lacerte had better be prepared to produce many more years of Steady Eddie growth if he wants to live up to those expectations.

"how" - Google News

December 07, 2020 at 06:30PM

https://ift.tt/3otRA3r

How Bill.com, The Boring Bookkeeper Of Fintech, Became One Of 2020's Hottest Stocks - Forbes

"how" - Google News

https://ift.tt/2MfXd3I

Bagikan Berita Ini

0 Response to "How Bill.com, The Boring Bookkeeper Of Fintech, Became One Of 2020's Hottest Stocks - Forbes"

Post a Comment