Job losses caused by the coronavirus pandemic have threatened to disrupt health coverage for millions of people as most working-age adults get coverage for themselves and their families through their work. Tracking real-time changes in coverage and the uninsured rate is difficult to do with much precision because the large national surveys that produce these estimates lag by months or years, and private surveys generally lack sufficient sample to measure coverage changes precisely. Many real-time surveys have faced challenges of high rates of survey nonresponse (not responding to the survey or particular questions) particularly among populations most likely affected by the economic downturn, including the Census Bureau’s Household Pulse Survey. However, various sources of administrative data allow us to piece together what might be happening to health coverage rates amid the pandemic.

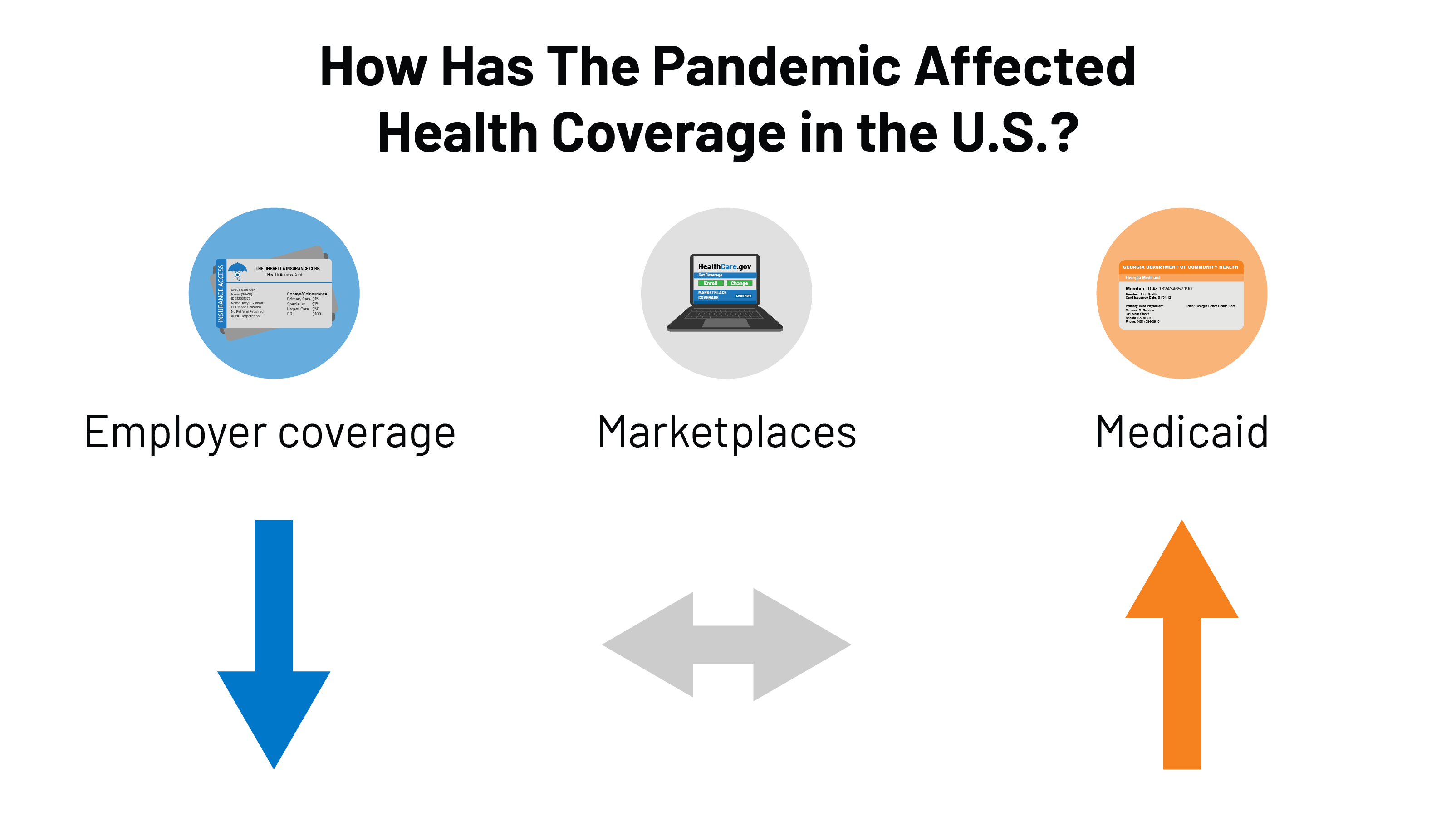

Declines in employer sponsored insurance are far less than overall declines in employment. First, using administrative data insurers file with state regulators (compiled by Mark Farrah Associates TM), we can see how enrollment in employer plans has changed through the end of September. Although employment rates fell by 6.2% from March to September, enrollment in the fully-insured group market decreased by just 1.5% over the same period.

If we extrapolate this finding to the entire group market, including self-insured employer plans, this would suggest that a total of roughly 2 to 3 million people may have lost employer-based coverage between March and September. To be very clear, this is only a rough estimate. We do not have reliable data for self-insured employers (which insure about 6 in 10 people with employer coverage and tend to be larger), and those employers may have made different decisions than fully-insured employers did about layoffs and whether and how to maintain coverage for employees.

Loss of employer-based coverage may have been offset by strong enrollment in Medicaid and Marketplaces. Many of those who lost job-based health coverage would have qualified for Medicaid or for a special enrollment opportunity to purchase individual market health coverage (either on- or off- exchange). Preliminary administrative data for the Medicaid program shows enrollment increased by 4.3 million people (6.1%) from February through July 2020. More recent data for 30 states show that enrollment in managed care plans increased by about 5 million, or 11.3%, from March to September 2020. Nationally, MCOs cover over two-thirds of Medicaid beneficiaries. States attribute these increases to rising unemployment (and loss of employer sponsored insurance) as well as the “maintenance of eligibility” (MOE) requirements tied to a 6.2 percentage point increase in the federal match rate (FMAP) authorized by the Families First Coronavirus Response Act (FFCRA) – which prevents states from disenrolling Medicaid beneficiaries if they accept the additional federal funding.

Using the same administrative data above (from Mark Farah Associates TM), we find that enrollment in the individual market was fairly steady from March to September 2020. In normal years, there is typically more attrition during these months as more people leave the market than come in during special enrollment periods (SEP). However, SEP enrollment was higher this year in healthcare.gov and state based exchanges.

While much is unknown, a review of administrative data suggest that the uninsured rate may not have changed much during the pandemic to date. There is still much we do not know, and these administrative data do not account for other changes like people aging on to Medicare and population growth. Nonetheless, it appears that the decline in employer-based health insurance coverage may have been offset by gains in Medicaid and largely steady enrollment in the individual market.

There are several possible explanations for the relatively modest decrease in employer-based coverage despite massive job losses. First, many of the people who have lost employment likely were never enrolled in coverage through their job in the first place; lower wage workers are less likely to be covered by their employer’s plan and, similarly, job losses have been highest and most sustained among industries that tend to have lower coverage offer rates (e.g., retail, service, hospitality). Second, many people who lost their jobs may have been able to retain their health coverage temporarily. A number of employers elected to keep furloughed or laid off workers enrolled in their firm’s plan at least in the short term. In addition, an unknown number of permanently laid off employees may have elected COBRA (which would be classified as group coverage) at their own expense, although this number is likely small due to the high costs of such coverage. Employment rates are starting to recover but a larger share of people filing unemployment claims say their job loss is permanent compared to earlier in the pandemic, suggesting there may be more coverage loss to come.

That the uninsured rate may not have substantially changed this year could be taken as both good news and bad news. A largely flat uninsured rate would be good news because health insurance coverage rates tend to fall whenever there is an economic downturn in the United States. Between many employers maintaining coverage and the Affordable Care Act along with Medicaid serving as a safety net for those who did lose coverage, the uninsured rate in the U.S. does not appear to have risen nearly as much as it could have, given the scale of employment losses.

The bad news is that, if the uninsured rate has indeed held steady, there are still tens of millions of people without health coverage during the worst pandemic to hit the country in one hundred years. Despite some recent legislation and administrative action aimed at protecting the uninsured from some of the costs associated with COVID-19 testing and treatment, those without coverage still face tremendous financial and health risks.

Four out of ten people who were uninsured before the pandemic could be getting health insurance coverage for free, either through Medicaid or a zero-premium bronze plan on the exchange. Open Enrollment for 2021 coverage on the ACA exchange markets is now in its fifth week and early figures show that, while overall enrollment is strong, new enrollment is about the same as past years. The Trump Administration has drastically reduced funds for ACA outreach and marketing activities, as well as for navigators who help people enroll in Marketplace coverage. President-elect Biden has vowed to reinstitute funding for ACA marketing, outreach, and navigator programs. The federal Open Enrollment period will have ended by the time Biden takes office, but he could open a new SEP without limitations on who qualifies to enroll.

"how" - Google News

December 10, 2020 at 03:33AM

https://ift.tt/3gvLjS5

How Has the Pandemic Affected Health Coverage in the U.S.? - Kaiser Family Foundation

"how" - Google News

https://ift.tt/2MfXd3I

Bagikan Berita Ini

0 Response to "How Has the Pandemic Affected Health Coverage in the U.S.? - Kaiser Family Foundation"

Post a Comment